Samantha Vuignier | Getty Images

Whether you’re resolving to cut your 2020 tax bill or save more for retirement in the new year, it’s time to start planning.

It’s hard to believe, but we’re staring down at the third year under the new Tax Cuts and Jobs Act — the overhaul of the tax code that took effect at the start of 2018.

Changes to the tax law included a reduction to the individual income tax rates, a doubled standard deduction and the elimination of personal exemptions.

Every year, the IRS bumps up the individual income tax brackets, adjusting for inflation.

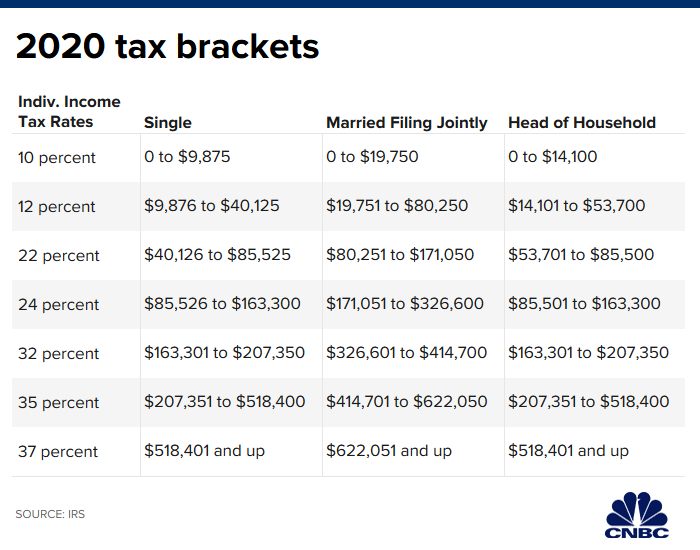

There are seven brackets, ranging from 10% to 37%, and they apply to taxable income — that is, your adjusted gross income after taking the standard deduction or your itemized deductions.

Each of these rates will apply to the taxable income within the dollar range.

Here are 2020’s individual income tax brackets:

The standard deduction for 2020 is $12,400 for singles and $24,800 for married joint filers.

There is also an “additional standard deduction,” for older taxpayers and those who are blind.

A married filer who is blind or aged 65 and over can claim $1,300 for themselves. Two married filers who are both over 65 or blind can claim $2,600 collectively, unchanged from 2019.

Single filers who are blind or over 65 are eligible for a $1,650 additional standard deduction. This is up $50 from 2019.

Adding to retirement savings

WHL | Getty Images

Resolve to save a few more dollars in your retirement accounts in 2020.

The IRS has raised the employee contribution limit for 401(k), 403(b) and most 457 plans to $19,500, up from $19,000 in 2019.

If you’re 50 or older, you can sock away another $6,500 in that workplace retirement plan. That’s up from $6,000 in 2019.

The contribution limit for individual retirement accounts, whether traditional or Roth, is holding steady at $6,000, plus another $1,000 for savers 50 and over.

The IRS limits high-income earners’ ability to make direct contributions to Roth IRAs — accounts in which you can save after-tax dollars, have the money grow tax-free and use it in retirement free of taxes.

In 2020, if your adjusted gross income exceeds $124,000 and you’re single ($196,000 for married couples filing jointly), you won’t be able to make a full contribution directly to a Roth IRA.

Instead, those savers might consider using a strategy known as the “backdoor Roth,” where they make a nondeductible contribution with after-tax dollars to a traditional IRA and then convert it to a Roth.

Saving for health care

sturti | E+ | Getty Images

This fall, if you signed up for a high-deductible health plan for 2020, get ready to fund that health savings account.

So-called HSAs allow those insured by a high-deductible plan to put away pretax or tax-deductible money and have it grow tax-free. You can take a tax-free distribution to pay for qualified health expenses.

In 2020, you can save up to $3,550 if you’re an individual with self-only health coverage. That’s up from $3,500 in 2019. Account holders with family plans can save up to $7,100 in this account (up from $7,000 in 2019).

HSAs differ from health-care flexible spending accounts primarily in that you can roll over the HSA balance from one year to the next. Further, you don’t need to be in a high-deductible plan to enroll in an FSA.

Balances in health-care FSAs, which are not tied to high-deductible health plans, generally must be used by the end of the plan year.

The IRS also bumped up the amount you can save in a health-care FSA: It will be $2,750 in 2020, up from $2,700 in 2019.

Gifts and inheritances

© Peter Lourenco | Moment | Getty Images

The Tax Cuts and Jobs Act also nearly doubled the amount that decedents could bequeath in death — or gift over their lifetime — and shield it from federal estate and gift taxes, which are 40%.

Before the tax overhaul, this so-called gift and estate tax exemption was $5.49 million per person.

For 2020, the lifetime gift and estate tax exemption will be $11.58 million per individual, up from $11.4 million in 2019.

Finally, the annual gift exclusion — the amount you can give to any other person without it counting against your lifetime exemption — will hold steady at $15,000 for 2020.