Check out the companies making headlines in midday trading.

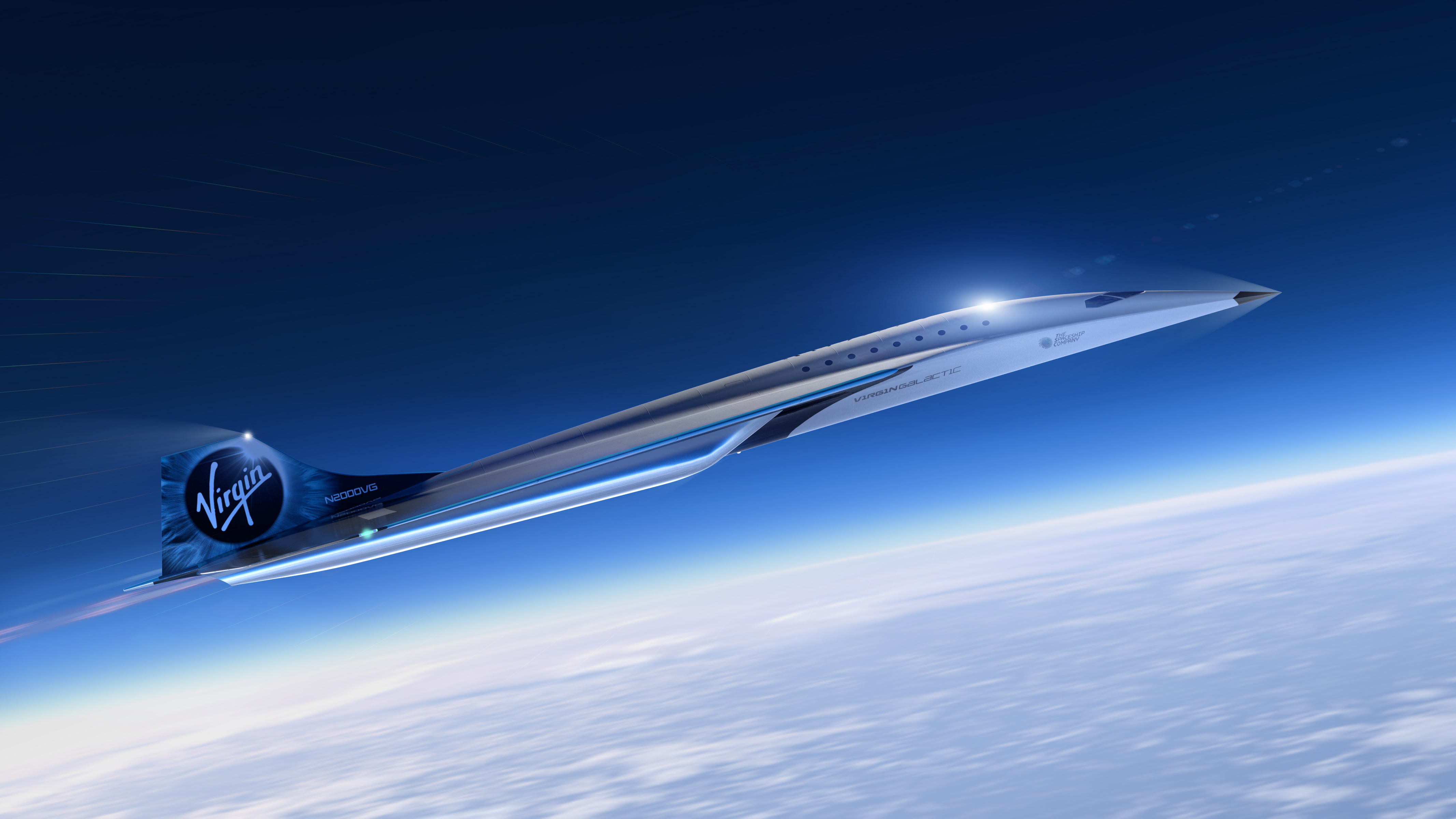

Virgin Galactic — Shares of the space tourism stock slipped more than 5% after Goldman initiated coverage on the company with a neutral rating. The firm is the only one on the Street to have less than a buy-equivalent rating on the stock. Goldman said the company’s “long-term upside potential could be substantial,” but noted that question marks remain.

Mattel — Mattel shares rallied more than 12% after the toy maker reported quarterly results that beat analyst expectations. The company posted earnings of 95 cents per share on revenue of $1.63 billion. Analysts had forecast a profit of 39 cents per share on revenue of $1.46 billion, according to Refinitiv. The strong results were driven in part by better-than-expected sales from the company’s dolls segment. Mattel also expects holiday season sales to grow.

Snap — Shares of the social media company jumped another 8% as the stock continues to climb following Snap’s third quarter results, which beat analyst estimates on the top and bottom line. The stock is on pace for its best week on record, with shares up more than 50% for the week.

Shake Shack — Shares of the restaurant chain gained more than 3% after Oppenheimer initiated coverage on the stock with an outperform rating. “We believe SHAK holds unique optionality as its strong unit economics drive the industry’s best unit growth story,” the firm said in a note to clients.

Intel — Shares of the chipmaker lost more than 11% after Intel reported weaker-than-expected revenue for its data center unit during the third quarter. The company also reaffirmed the delay of its next generation chips. Intel’s overall earnings and revenue results were roughly in line with projections.

Boston Beer Company — Shares of the beverage company jumped more than 15% to a new all-time high following Boston Beer’s third quarter results. The company earned $6.51 per diluted share, which was ahead of the $4.63 expected by analysts surveyed by FactSet. Revenue grew 30% year over year. The company also said it would earn between $14 and $15 a share this year, well above its prior guidance of $11.70 to $12.70.

Cleveland-Cliffs — Shares of the iron ore producer jumped 6% after the company beat earnings estimates for the third quarter. “As we continue to fulfill orders for our automotive customers at a remarkably healthy pace, with our facilities back to normalized operating rates and with current pricing, we would expect further sequential improvement in our adjusted EBITDA performance in Q4,” CEO Lourenco Goncalves said in a statement.

Snowflake – Shares of Snowflake fell more than 5% to below $280 apiece amid a broad sell-off in technology shares on Friday. The cloud company enjoyed a blockbuster market debut in September with its share price more than doubling on the first day of trading. The stock has fluctuated since, but is still significantly higher than its IPO price of $120.

Fastly – Shares of Fastly dropped nearly 5% after Piper Sandler downgraded the cloud computing services provider to an underweight rating from neutral. The firm cited concerns about slowing business from TikTok, which is the company’s single largest customer. Last week Fastly dialed back its third-quarter revenue guidance and withdrew its full-year forecast.

Bloomin’ Brands — The restaurant stock sank 10% despite beating Wall Street expectations for its third quarter. The company reported a loss of 12 cents per share and $771.3 million in revenue. Analysts surveyed by Refinitiv expected a loss of 33 cents per share and $750.6 million in revenue. On a call with investors, management said it was difficult to predict consumer trends and capacity restrictions in December, a key period for the company, according to a FactSet transcript.

– CNBC’s Yun Li, Fred Imbert and Jesse Pound contributed reporting.

Subscribe to CNBC PRO for exclusive insights and analysis, and live business day programming from around the world.