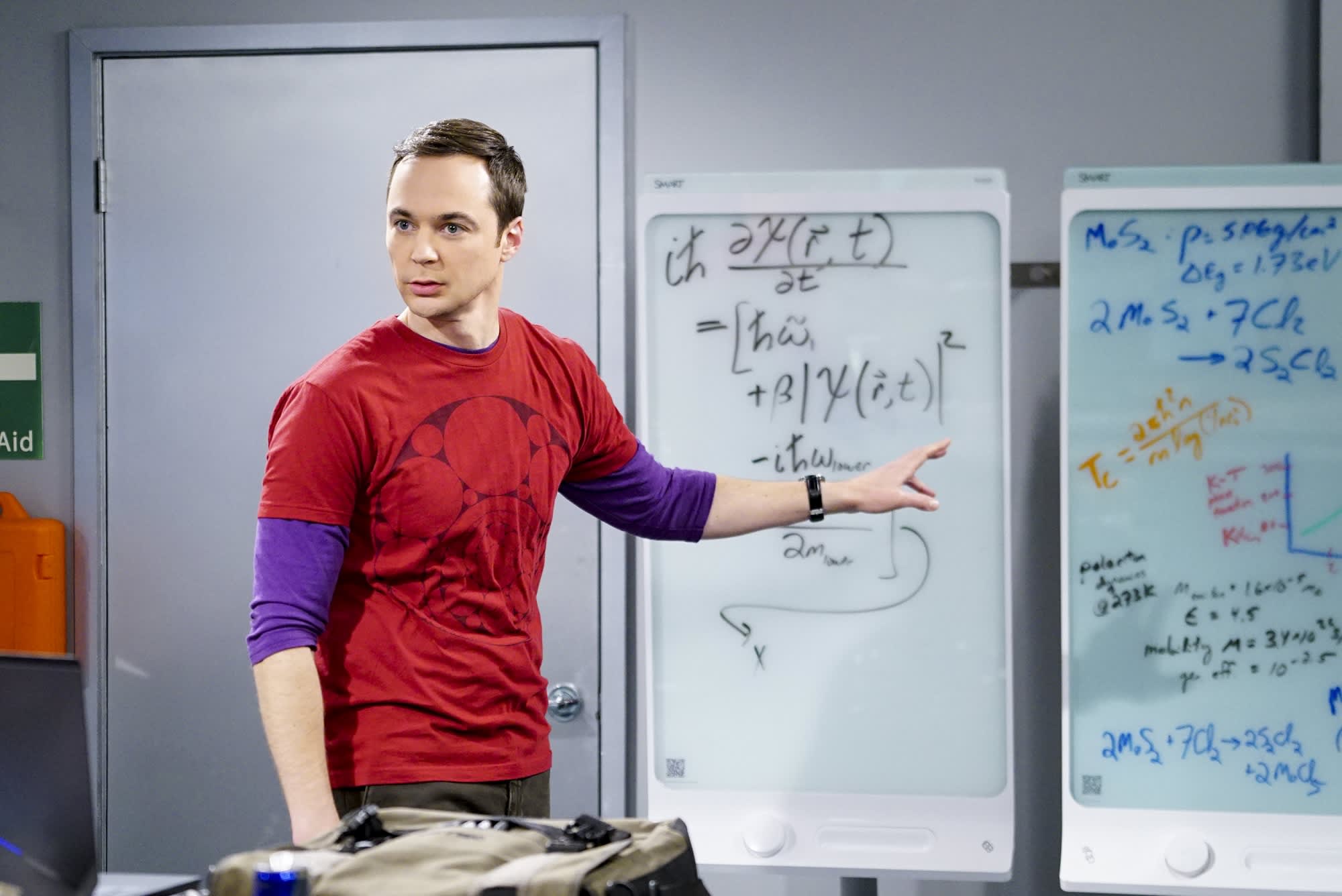

David Goetsch, co-executive producer of “The Big Bang Theory,” on the show set.

David Goetsch

I can’t stop reading the news about the coronavirus and its impact on the economy. My brain is hardwired to obsess on a crisis, even one which doesn’t impact me directly. Everything else gets pushed to the periphery while one calamitous problem fills my mind.

During the financial crisis of 2008-2009, I thought the world was going to end. (I never predicted that a more than 50% drop in the stock market would precede the longest bull market in history.)

I think I know why my mind operates this way. In first grade, I ran through a plate-glass window. I went from being a kid chasing a friend to a patient in an ambulance losing gallons of blood. I have a fight-or-flight mechanism — if I’m being honest, it’s all flight — that gets activated anytime a big crisis happens. All of these disasters push the same button.

More from Invest in You:

Market plunge has people pondering move to cash

Expert answers to your coronavirus money questions

Suze Orman: How to handle money fears amid pandemic

But with COVID-19, I’m not as anxious as I’ve been before. The question is, why not?

A few years ago, my friend and legendary investor, David Booth, told me that I needed “to have a philosophy with investing, just like I did in life.” What struck me was that, while I felt like I did have a philosophy with investing, I didn’t really have one in life. I wondered if I could reverse-engineer things. Could I apply investing lessons to everything else?

The answer is yes. Here’s how:

Start with science: For a long time, I thought investing meant playing the stock market. I didn’t know about the academic research that led to a kind of investing not based on speculation. This science has been like a warm blanket for me in planning for my kids’ college funds, as well as my retirement. And this kind of logic-based thinking has helped me cope with more problems in my life than just investing.

When I think about COVID-19, I go to the science.

Accept uncertainty: Unfortunately, there is a lot that science does not know about COVID-19. We don’t have a vaccine and we don’t know when we will. That’s really hard for me, like so many. As much as science makes fact-based conclusions — about investing or a virus — there will always be a range of possible outcomes. We don’t know how the future is going to play out.

This might drive me crazy had investing not already taught me so much about uncertainty. Remember how that 50% market drop led to the biggest bull market in history? I can’t tell you what is going to happen tomorrow. But I can talk about a range of possible outcomes five, 10 and 20 years from now based on the last 100 years of market data.

I don’t know where we’ll be with this virus a month from now, but I think in a year or two we’ll have a vaccine that will mitigate this scourge, like the ones before it.

Know your risk tolerance: Each person can tolerate a different level of risk. Some people are more vulnerable to uncertainty — in markets and with illness — because of their age, medical condition or worldview.

How can we get an accurate picture of risk tolerance before the unexpected happens?

My financial advisor has been a great source of insight on this, and not just when it comes to my investments.

I take real comfort in being a long-term investor focused on controlling what I can control while accepting that uncertainty is inevitable.

David Goetsch

TV producer and writer

Be a long-term investor — in markets and in life: More than anything, think long-term. Day to day, it’s easy to get caught up in the noise. When I think long-term, I feel less emotional and more pragmatic. How do I get to the other side of this problem? What have my past experiences taught me about the present situation? I may not know when the uncertainty will end, but the longer my time horizon, the better my chances are of having a positive outcome.

The stock market seems freaked out about the coronavirus, which makes perfect sense. It’s made up of millions of buyers and sellers who, like me, are trying to process all the new information that can affect stock prices. I take real comfort in being a long-term investor focused on controlling what I can control while accepting that uncertainty is inevitable. I think I’ve set myself up for my best shot at success.

I’m still worried about everything that’s going on. How could I not be? But I’m much better off than I was before I had this philosophy, and for that I am deeply grateful.

— By David Goetsch, TV producer and writer. Goetsch was a co-executive producer of “The Big Bang Theory.”

SIGN UP: Money 101 is an 8-week learning course to financial freedom, delivered weekly to your inbox.

CHECK OUT: Clean your phone at least once a day, says infectious disease specialist — here’s how via Grow with Acorns+CNBC.

Disclosure: NBCUniversal and Comcast Ventures are investors in Acorns.